Infuse Liquidity into Investments

Invest more, pay less with Margin Trading Facility (MTF)

Key Features

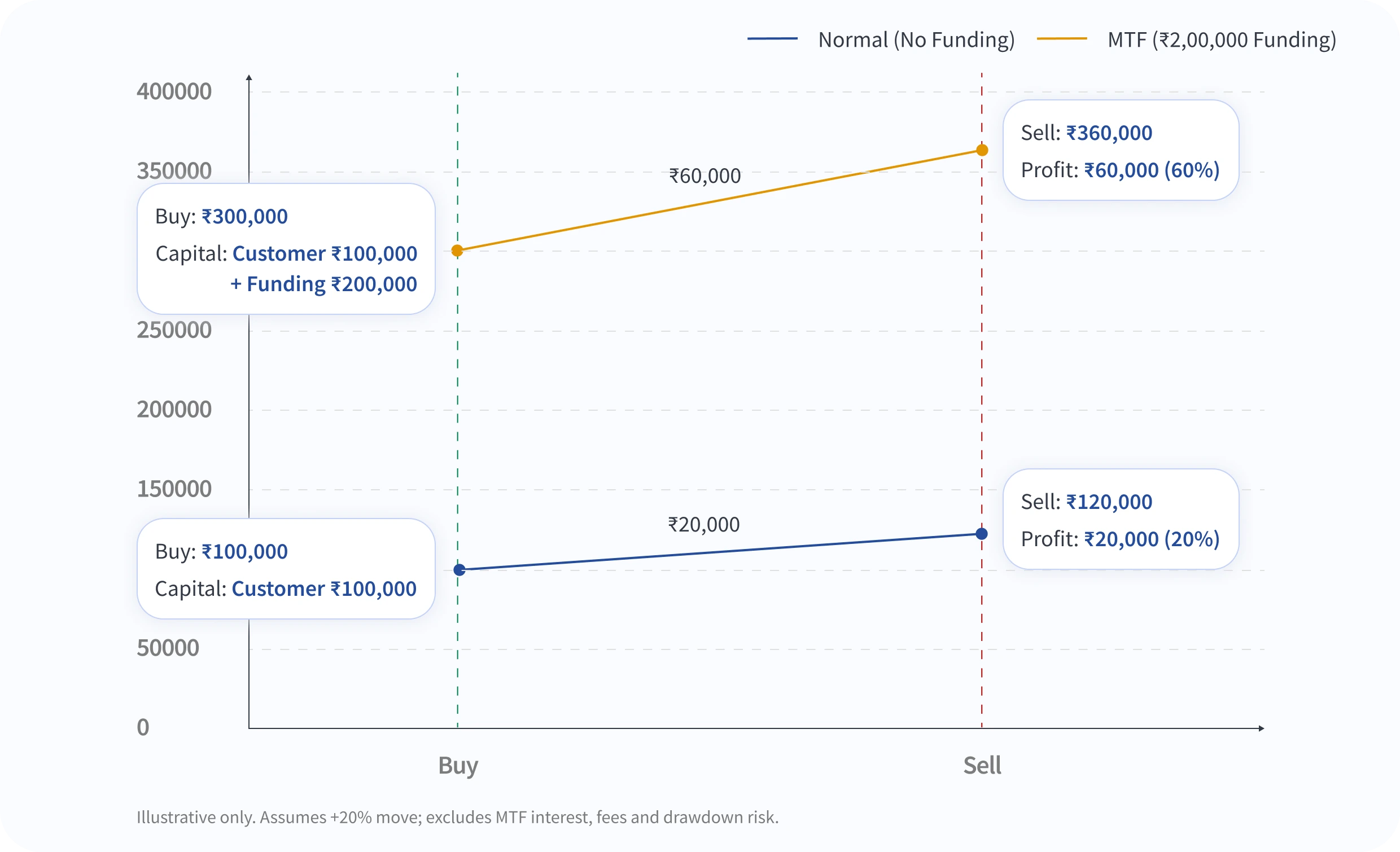

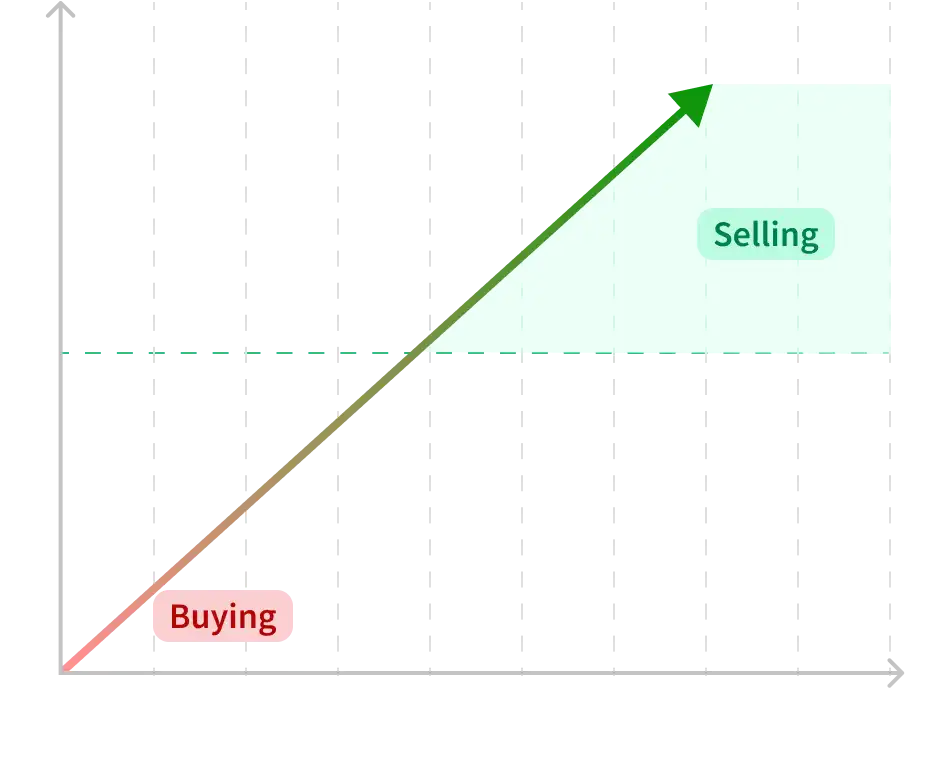

Power up your profit

Turn ₹1 Lakh into ₹4 Lakh buying power & multiply your profit potential.

Expert MTF research insights

Access to MTF Research recommendations.

Unlock Higher Returns

Your gains can go beyond your capital contribution.

Lower interest rates

Pay Interest on what you borrow.

Profit Calculator

Customer Pay

Margin Fund

| Features | Customer Pay | CBL Funding | Buy Price | Sell Price | Profit |

|---|---|---|---|---|---|

| Normal Buying | ₹1,00,000 | ₹0 | ₹1,00,000 | ₹1,20,000 | 20% |

| MTF Buying | ₹1,00,000 | ₹2,00,000 | ₹3,00,000 | ₹3,60,000 | 60% |

Normal Buying

Customer Pay

₹1,00,000

CBL Funding

₹0

Buy Price

₹1,00,000

Sell Price

₹1,20,000

Profit

20%

MTF Buying

Customer Pay

₹1,00,000

CBL Funding

₹2,00,000

Buy Price

₹3,00,000

Sell Price

₹3,60,000

Profit

60%

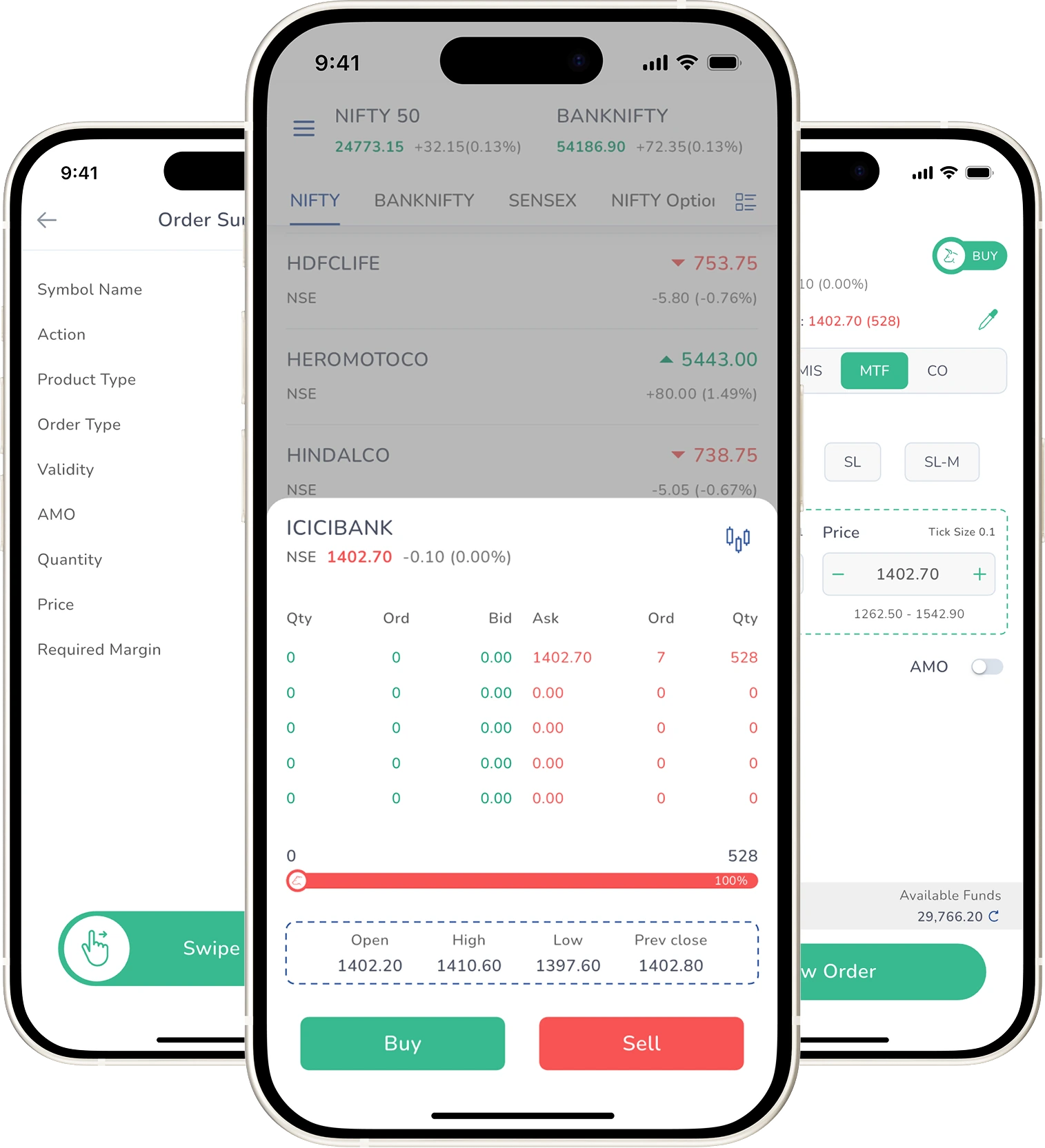

Get started with MTF in 3 simple steps

Select the Stock

Choose the Stock you wish to Buy.

Then Select MTF

On the buy page, select MTF, then input quantity and price.

Confirm & Place Order

Review order details and click on Buy to place order.

Frequently Asked Questions

Only certain stocks are approved for trading under the MTF as per SEBI guidelines and CBL’s internal risk policies, you can view the list of MTF approved stocks through www.

F&O stocks: VAR + 3 × ELM.

Other Group stocks / Equity ETFs: VAR + 5 × ELM.

There might be a slight difference as per CBL internal RMS policies

MTF can be held until the margins are maintained in the account.

Pledge-repledge framework mandates that funded shares and collateral be held only via depository pledge to the CBL “Client Securities under Margin Funding A/c”. OTP confirmation (T day or T+1) is compulsory for pledging of shares.

Yes. Select MTF on order-pad for placing an MTF order.

CBL will square off the funded quantity on T+1 day, and delayed payment charges for one day will be applied.

Yes, interest will start accruing on a calendar‑day basis from T+1 onwards. It will be calculated for each day (including weekends and holidays) after the transaction date.

Yes, MTF holdings can be partially converted to delivery. You have the flexibility to settle a portion of your MTF position by paying the required funds and taking delivery of those shares into your demat account, while the remaining portion can continue under MTF.

Yes, you will be eligible to receive any dividend declared by the company, provided you were holding the stock in your account on the company’s specified record date, the cut‑off date used to determine which shareholders qualifies for the dividend payout.

Margin pledge allows you to unlock additional trading limits by pledging your existing shareholdings, enabling you to use them as collateral for further trades. In contrast, an MTF pledge involves the mandatory pledging of shares that were purchased using borrowed funds under MTF. These pledged shares remain as security until the borrowed amount is repaid, and interest is charged on the funded portion for as long as it remains outstanding.

To exit an MTF position, you can either sell the shares that were purchased under MTF through your MTF Positions, or convert them into delivery by paying off the funded amount (including any accrued interest and charges). Once the dues are cleared, the pledged shares are released from the MTF pledge and credited to your demat account as fully owned holdings.